The Taskforce on Nature-related Financial Disclosure (TNFD) presented final recommendations on 18th September at Climate Week NYC. This included final recommendations and additional guidance for financial institutions.

Recommended Disclosures

Included same 4 pillars as TCFD (Governance, Strategy, Risk Management, Metrics & Targets).

All 11 TCFD recommended disclosures are included.

3 further disclosures are included, covering: engagement (Governance, C), sensitive locations (Strategy, D), and value chains (Risk, A(ii))

Nature related framework (dependency, impact, risk, opportunity)

The report outlines nature-related risks and opportunities across four concepts

Dependencies – of the organisation on nature;

Impacts – on nature caused, or contributed to, by the organisation;

Risks – to the organisation stemming from their dependencies and impacts; and

Opportunities – for the organisation that benefit nature through positive impacts or mitigation of negative impacts on nature.

Nature-related risks and opportunities arise from an organisation’s dependencies and impacts on nature, as outlined in their impact dependencies framework below.

Following the impact dependency framework

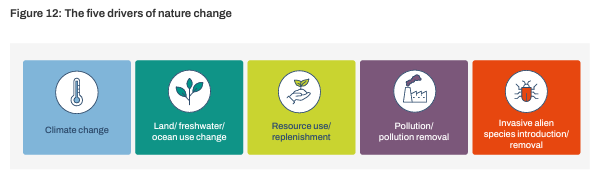

The report outlines 5 key drivers of nature change:

These drivers of change can then enhance or degrade ecosystem services. External factors include both natural forces and human activities outside the organisation that affect the state of nature. These could include a natural disaster or the pollution released by another organisation.

These changes to the state of nature can be positive (enhancement) or negative (degradation), and refer to changes to: • The condition and extent of ecosystems; and • Species population size and extinction risk.

Nature-related risks are potential threats posed to an organisation that arise from its and wider society’s dependencies and impacts on nature.36 Risks can be physical risks, transition risks or systemic risks.

Mapping sectors to biodiversity loss drivers

Comments